- Offshore data and events drove financial markets

last week. A hawkish dissent to the Fed rate cut and a hot

Aussie inflation print saw expectations for further easing

from the Fed and RBA pared back. That repricing found its

way to Kiwi markets, with yields climbing in sympathy and

the Kiwi dollar under pressure. - The US and China

have landed on a trade deal. The average tariff rate on

Chinese imports will be reduced to under 50%. And in

exchange, China will pause its control on rare exports and

purchase more US soybeans, oil and gas. Question is: how

long will this truce last? - We really want to

highlight our most recent podcast episode “Unlocking

efficiency one robot at a time” where we join the team

at DSL logistics to get the inside scoop on how cutting-edge

robotics have transformed their Kiwi

business.

Here’s our take on current

events

We had a big week of international

announcements and data. A lot of it coming from the

US…

Highly anticipated trade talks between the US

and China seemingly went well with President Trump even

rating his meeting with President Xi a 12 out of 10. The two

parties have agreed to a one year “truce”, alleviating

trade tensions for now. Within the truce, China has agreed

to forgo its export restrictions on rare earth metals, buy

US soybeans, and undergo stricter export controls on

precursor chemicals used in the production of Fentanyl. In

exchange, Trump relaxed some of the tariffs on Chinese

imports. The average tariff rate on China is now down to 45%

(previously 55%). It’s a move in the right direction, and

certainly a better outcome than the additional 100% tariff

Trump threatened just a couple of weeks ago. But even at

45%, tariffs on China remain at levels that are likely to

weigh on China’s growth. And subsequently continues to

risk weighing on our own growth and recovery here at

home.

Advertisement – scroll to continue reading

Nevertheless, with that ticked off Trump’s

list, we hope his attention turns to addressing the ongoing

US Government shutdown. With every week that passes, the

shutdown is estimated to deduct 0.1% of annualised GDP. And

today marks day 33 of the shutdown, with the closure on the

brink of becoming the longest shutdown in US

history…

Movements in financial markets over the

last week however were centred around the US Fed. The 25bps

cut to the fed funds rate was as expected. But the decision

came with two dissents. Governor Stephen Mirran opted for a

50bps cut – big shock (not). But the Kansas City Fed

President Jeffrey Schmid voted for no change. The hawkish

dissent was unexpected and seemingly supported by commentary

from Fed chair J. Powell. In remarks during his press

conference, Powell pushed back on a predetermined 25bps cut

in December, commenting that a third consecutive cut was

“not a forgone conclusion, far from it ”. Such

comments saw a swift pare back in expectations for the

December meeting with markets going from having over a 90%

chance of a cut priced to just 50% priced in. As expected,

the pullback saw US rates across the curve jump higher. Both

the US 2yr and 5yr lifted ~10bps higher following the

announcement and press conference.

Meanwhile in

currency markets, the Kiwi lost some strength against the US

dollar as expected. Shortly after the announcement the

NZDUSD fell from around .5790 to .5752, with further falls

to a low of .5715 in the days that followed. Currently the

Kiwi Dollar sits in the low .5720’s at time of

writing.

The repricing of Aussie rate cut expectations

following a hot inflation print also spilt over to our

markets. Aussie annual inflation printed above expectations,

up 3.2% over the September quarter. The acceleration follows

the unwind in energy rebates. The disinflationary force

previously provided by goods inflation is also waning. At

the same time, there’s persistent strength in services

inflation which is still running at 3.5%.

Further

confirming that the recent reacceleration is not being

driven by one-off increases, measures of underlying price

pressures also printed hot. Trimmed mean inflation lifted to

3% on the year, climbing to the top of the RBA’s 2-3%

target band. The September inflation update is a hard one to

look through, and will have to result in a higher inflation

outlook. The RBA expected trimmed mean to fall to 2.6% by

the end of the year. That looks unlikely now. Market

reaction to the report was swift, with a strong sell-off in

Aussie rates as a rate cut this week was priced out. Some

local commentators have even called the end of the easing

cycle. Kiwi rates rose in sympathy, with the 2year swap

climbing about 20bps above the cycle low – although Friday

saw some of that lift unwind.

Last week’s moves in

Kiwi rates and currency were largely driven by offshore

developments. There has been no change to the domestic

economic outlook. We still expect the RBNZ to deliver

another 25bps at the November meeting.

This week our

attention turns to Stats NZ’s suite of labour market data

out on Wednesday. We expect that conditions in the labour

market loosened a little bit further over the quarter. In

some good news, there are signs that the market is beginning

to stabilise. 2026 should be a better year. But right here,

right now, labour demand is not yet strong enough to absorb

the extra supply entering the market. (See

our full preview here).

We expect the unemployment

rate to increase to 5.3% from 5.2% – the highest in over

eight years. Though a key assumption to the rise in the

unemployment rate is a continued drop in labour force

participation. The participation rate soared to an all-time

high of 72.4% in June 2023. A surge in migration supplied

much needed work-ready migrants, and a cost-of-living crisis

pulled many off the sidelines. But with waning demand,

workers have headed for the exits. As such, we’ve seen a

gradual decline in the participation rate. And we expect a

further fall in participation from 70.5% to 70.4% – the

lowest since Dec 2019.

At the same time, growing slack

within the labour market should also see wage growth

continue to moderate. We expect to see a 0.4% quarterly rise

in wages, pulling down the annual rate from 2.3% to

2.1%.

Altogether the data should reinforce the need

for further monetary policy easing. Downside risks to

medium-term inflation are growing given the soft labour

market and dimming global outlook. We continue to expect the

RBNZ to cut the cash rate by 25bps at the November

meeting.

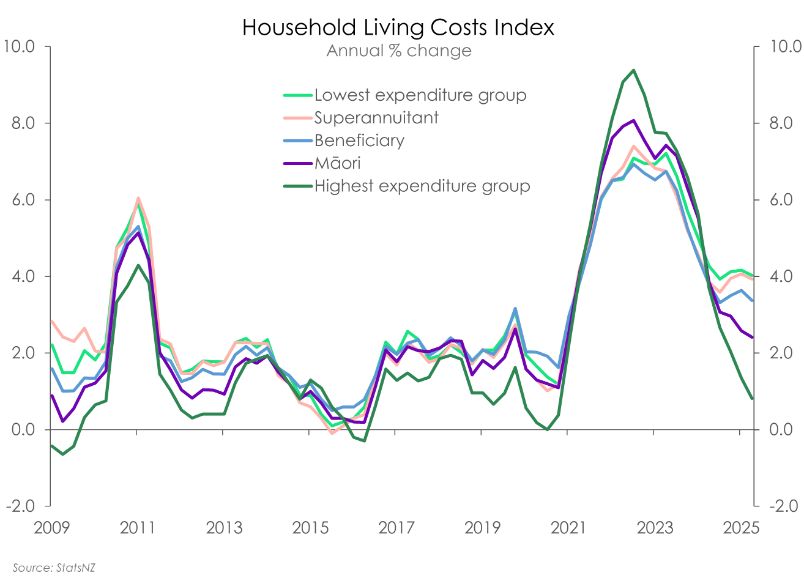

Charts of the Week: Inflation’s uneven

bite: Who’s hurting most?

Inflation is hurting some

more than others. It’s unfair. StatsNZ’s Household

Living-Cost index showed that living costs for the average

Kiwi household continue to ease. But there is a widening gap

across different Kiwi households.

Living costs for the

average Kiwi household were up 2.4% in the year to September

2025, down from 2.6% last quarter. But for households in the

highest expenditure group, costs rose just 0.8%. In

contrast, those in the lowest expenditure group, saw costs

rise by 4%. Households that spend the least, and have the

tightest budgets, are experiencing the highest

inflation.

The disparities don’t stop there.

Superannuitants and beneficiaries are also feeling the pinch

with living costs rising 3.9% and 3.4% respectively. Māori

households are faring a bit better, with living costs up a

shallower 2.4%. But that’s still 3 times above the

increase of those amongst the highest spending

households.

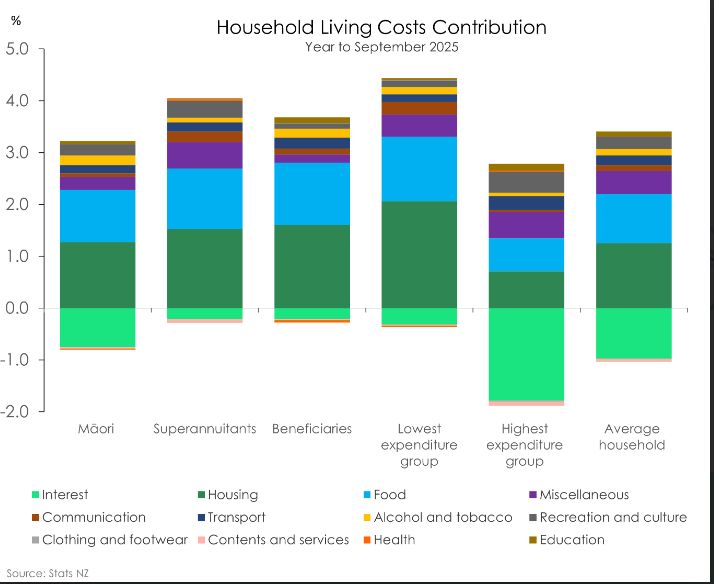

Interest rates have been the leading

driver behind the story of who’s paying the most. From the

sharp rise over 2022-23, to the steep declines over the past

year.

With interest rates now falling, interest

repayments are down 14.3% for the average household. It’s

a move which has had a sizeable impact in reducing living

costs across all Kiwi. But one which has been felt most by

households amongst the highest expenditure group as higher

carriers of debt.

For households within the highest

expenditure group, interest repayments hold a 12% weighting

towards their cost of living. That’s almost double that

for the average household (6.8%). So when interest rates

were rising, they were hardest hit. Now, the move down is

providing relief. Interest repayments have fallen close to

15%. It’s the reason why these households are recording

the lowest annual inflation, deducting as much as 1.8% from

their cost of living.

For other groups, particularly

superannuitants and beneficiaries, the fall in interest

repayments, have had less of an impact. Repayments hold less

than a 2% weighting for both groups. Simply because these

households are less exposed to holding mortgages. For

example, according to Stats NZ, just 8.5% of Kiwi retirees

have a mortgage.

All households are feeling the pinch

of rising costs across the housing and food groups. No

surprises there. Both housing and food are two areas where

the Consumer Price Index has flashed sizeable increases in

prices over the past year. But within housing, where most of

the inflation heat is coming from, separate subgroups are

driving up living costs across Kiwi households.